ADA Price Prediction: Can Cardano Reach $1 Amid Technical Consolidation and Foundation Expansion?

#ADA

- Technical Positioning: ADA trades below 20-day MA but shows bullish MACD momentum near lower Bollinger Band

- Foundation Support: $2.1M loan and exchange expansion initiatives provide fundamental backing

- Market Sentiment: Mixed technicals balanced by proactive ecosystem development efforts

ADA Price Prediction

ADA Technical Analysis

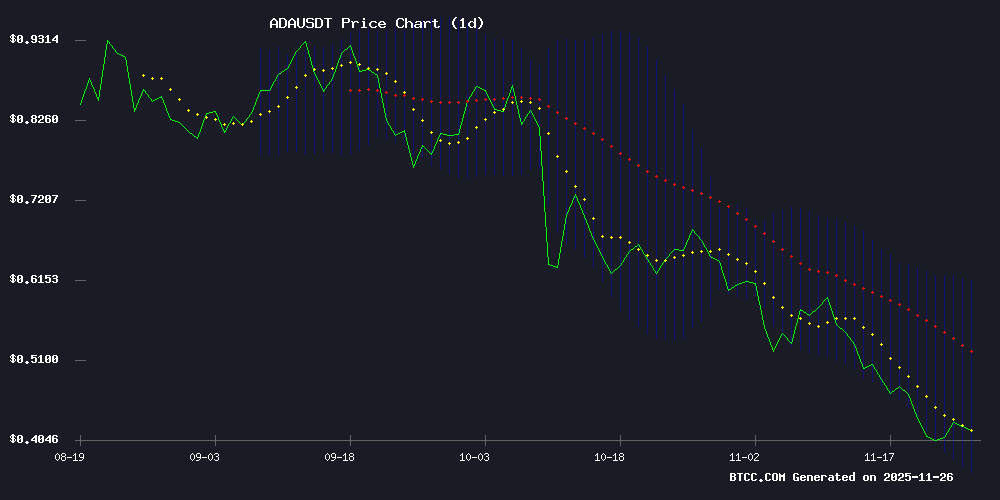

According to BTCC financial analyst Sophia, ADA is currently trading at $0.4251, below its 20-day moving average of $0.4885. The MACD indicator shows bullish momentum with the MACD line at 0.073923 above the signal line at 0.060463, generating a positive histogram of 0.013460. However, the price remains NEAR the lower Bollinger Band at $0.362401, suggesting potential oversold conditions. Sophia notes that while technical indicators show mixed signals, the current position relative to the Bollinger Bands may indicate a potential rebound opportunity.

Cardano Foundation Initiatives Boost Market Sentiment

BTCC financial analyst Sophia comments that recent Cardano Foundation announcements regarding a $2.1 million loan for global token listings and exchange expansion for ADA and SNEK tokens are generating positive market sentiment. However, Sophia cautions that these developments should be viewed in context with the current technical picture. The foundation's proactive approach to ecosystem growth could provide fundamental support, but investors should monitor whether these initiatives translate into sustained adoption and trading volume increases.

Factors Influencing ADA's Price

Cardano Foundation Approves $2.1M Loan to Boost Global Token Listings

The Cardano Foundation has greenlit a ₳5 million treasury withdrawal to expand international exchange listings for Cardano Native Tokens (CNTs). Initially proposed as a grant by the Snek Foundation, the revised repayable loan structure secured 85.71% approval from constitutional members.

This strategic move targets increased visibility for CNTs like SNEK across global trading platforms. The Foundation's initial August abstention—citing transparency concerns—gave way to support after Intersect oversight mechanisms and an advisory board were incorporated into the proposal.

Cardano Foundation Approves 5M ADA Loan Amid Chain Split Buzz

The Cardano Foundation has approved a 5 million ADA treasury loan, valued at approximately $2.07 million, to fund global listings of Cardano native tokens and expand its ecosystem. The decision, ratified through DRep voting, marks a shift from grants to loans, emphasizing accountability and fiscal discipline.

Snek Foundation, the proposal's submitter, delivered key milestones swiftly, enhancing token accessibility worldwide. However, a recent temporary chain split underscored lingering technical risks. Older nodes rejected a malformed transaction while newer ones processed it, resulting in no lasting network damage.

Initially hesitant due to unclear financial details, the Foundation gained confidence as Snek refined its proposal to meet governance standards. Remaining issues will be addressed collaboratively with Intersect post-loan agreement finalization.

Cardano Foundation Endorses Global Exchange Expansion for ADA and SNEK Tokens

The Cardano Foundation has voted in favor of a treasury proposal aimed at broadening the international exchange listings for Cardano Native Tokens (CNTs). The initiative, spearheaded by the Snek Foundation team, seeks to enhance liquidity and accessibility for ADA and related tokens across major trading platforms.

This strategic move aligns with Cardano's broader ecosystem growth objectives, targeting increased adoption and market penetration. The proposal underscores the Foundation's commitment to fostering infrastructure development for decentralized finance applications.

Cardano Founder Rejects Macroeconomic Influence on ADA

Charles Hoskinson, founder of Cardano, has publicly dismissed the notion that macroeconomic factors can dictate the trajectory of ADA. His remarks come amid repeated market turbulence attributed to external economic pressures.

The cryptocurrency sector, including Cardano, has faced volatility triggered by global financial conditions. Hoskinson's stance signals a defiance against traditional market forces influencing blockchain assets.

Will ADA Price Hit 1?

Based on current technical analysis and fundamental developments, BTCC financial analyst Sophia provides the following assessment regarding ADA's potential to reach $1:

| Current Price | Target Price | Required Gain | Technical Outlook | Timeframe Estimate |

|---|---|---|---|---|

| $0.4251 | $1.00 | 135% | Mixed | Medium to Long Term |

Sophia notes that while the Cardano Foundation's recent initiatives are fundamentally positive, achieving a $1 price target would require significant market momentum and broader cryptocurrency adoption. The current technical setup shows ADA trading below key moving averages but with some bullish MACD momentum. Reaching $1 would represent more than a 135% increase from current levels, which would likely require both strong technical breakout patterns and sustained positive fundamental developments across the broader Cardano ecosystem.